Understanding Business Credit Guidelines

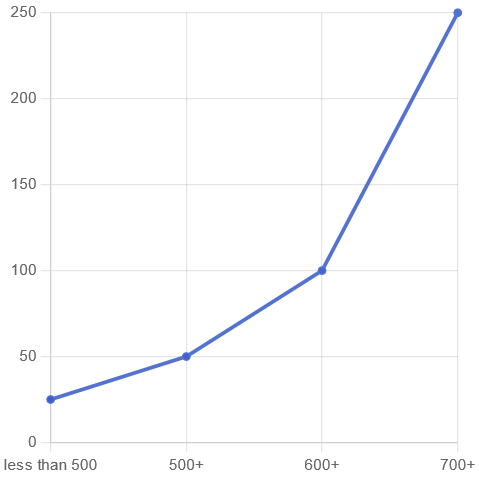

To qualify for a business loan, lenders typically look for a personal credit score first, then the next guidelines in a waterfall fashion. Credit score first, time in business, revenue, industry, use of funds and profitability then collateral. For banks, a minimum of at least 680 to even be considered otherwise you have to have strong deposits and collateral. If not, they’ll keep your deposits and savings, but not lend you any. If they do, they require you to open a bank account so they can use your own money to lend it to you while asking for collateral for the money that’s already being deposited. Alternative lender like online lenders may accept scores as low as 500 given you have revenue.

SKIN IN THE GAME

Most business owners forget the fact that you have to have skin-in-the-game for you to ask for someone else to take a risk.

For SBA loans, a minimum FICO SBSS score of 155 is often required. Business credit scores, such as those from Experian or Dun & Bradstreet, should ideally be 70 or higher. Higher credit scores generally lead to better loan terms and approval odds.

Basic Understanding For How You Can Predict What You Can Get Approved For?

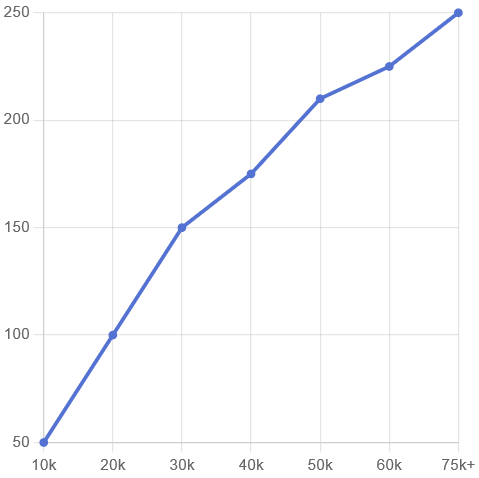

Gross Monthly Revenue

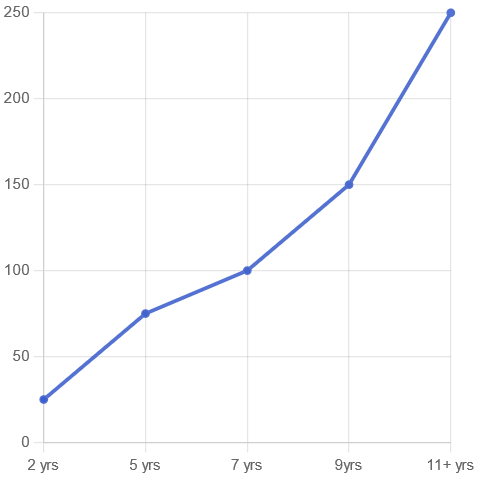

Years in Business

Personal Credit Score

Using cutting edge technology paired with over 20 years of industry experience, we provide custom funding options that make sense for you and your business. Amongst everything that goes into making a credit decision, there are three indicators (data points) that stand out most when determining quotes and maximum approvals: Revenue, Time in Business, and Personal Credit.