Unlocking Growth: The Definitive Guide to Equipment Leasing for Your Financing Business in the U.S.

Equipment leasing isn’t just another way to pay for gear—it’s a capital strategy. Used correctly,

it protects cash, extends runway, and lets you scale without bleeding equity or maxing out bank lines.

This guide walks through how serious operators use leasing to grow on purpose.

Unlocking Growth with Equipment Leasing

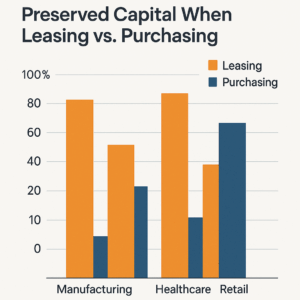

Leasing is not a “second choice” to buying—done right, it’s a deliberate strategy for preserving capital,

managing risk, and pushing growth without blowing up your balance sheet.

Equipment leasing is a strategic tool that helps preserve capital while enabling rapid Business Growth

for financing businesses across the U.S. By choosing operating leases or finance leases, you can manage cash flow and

minimize upfront cash-on-hand requirements, creating runway for hiring, inventory, and marketing instead of locking

everything into hard assets.

This guide highlights how equipment leasing supports project funding decisions, clarifies asset usage

considerations, and helps business owners weigh lease-versus-buy choices with objective recommendations rooted in actual

market knowledge—not theory.

For practical modeling and quick scenario analysis, use an interactive financing calculator that shows

how lease terms, rates, and structures behave under different cash flow assumptions. You’ll quickly see how the right

lease structure can turn a major capital expense into a controlled, predictable operating cost.

What to Look For in Leasing Partners

When evaluating equipment leasing providers, prioritize:

- Direct Lender status (not just a broker middleman)

- Same-Day Decisions capability when timing matters

- Automated Underwriting to shorten credit approval cycles

- Experience supporting specialty lenders and niche industries

- Proven track record with national players like Crest Capital or Currency Capital

Real-world examples include pizza shops upgrading ovens without draining reserves, and construction companies using

large equipment lending to scale capacity—all while keeping capital available for payroll, fuel, and bids.

Leasing, done properly, supports operational flexibility instead of choking it.

Exploring the Dynamics of Equipment Leasing & Capital Preservation

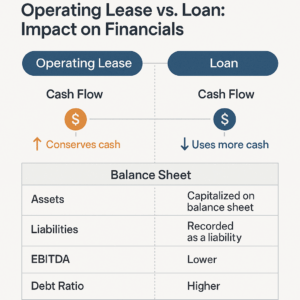

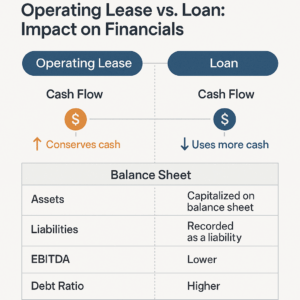

The real leverage in leasing comes from how it rewires your cash flow and balance sheet—not just the payment amount.

Exploring the dynamics of equipment leasing reveals multiple financing solutions tailored to preserve capital

and maintain liquidity for growing enterprises. Leasing functions as an operating expense alternative to

traditional business loans, which is why equipment leasing companies lean into flexible needs analysis and asset usage

optimization rather than one-size-fits-all structures.

A strong vendor finance program, or partnerships with independent leasing specialists, can create

vendor-friendly terms, quick Same-Day Decisions, and seamless integration with your sales activity.

Project funding via leasing allows small business managers to access the latest technology without heavy upfront capital

expenditure, freeing cash-on-hand for marketing, payroll, and execution—while reducing pressure on business banking lines.

For both start-ups and established businesses, comparing options like Crest Capital,

Spar Leasing, and National Funding alongside independent third-party providers can reveal

which partners truly understand your industry and can structure tailored financing solutions, instead of generic term sheets.

Practical tips include negotiating lease terms to match the actual equipment lifecycle and using lease rates

to forecast operating expense impact on EBITDA and margins. If the payment schedule doesn’t line up with

when the equipment actually generates revenue, it’s the wrong structure.

metrics (assets, liabilities, EBITDA, and debt ratios).

Essential Insights: What Every U.S. Business Needs to Know About Equipment Leases

Before you sign anything, you need to understand which gear qualifies, how terms stack up, and what really drives total cost.

Essential insights focus on which equipment qualifies, how lease terms affect total cost, and how to design

financing solutions that actually support Business Growth. Understanding new and used equipment valuation,

depreciation equivalents, and finance lease options is non-negotiable if you’re serious about long-term planning.

When researching equipment leasing companies, evaluate Industry Affiliations, documented

Industry Experience, and whether the firm supports vendor finance programs for

manufacturers and active sales teams. Small business leaders should request:

- Fact-checked quotes with all fees disclosed

- Real star ratings and client references

- A tailor-made offer based on operating expense budget and projected cash flow

- Clear explanation of residuals, early purchase options, and maintenance obligations

Direct Lender advantages like Same-Day Decisions and Automated Underwriting reduce friction in credit

approval for diverse business types—from pizza shops to heavy manufacturing. Use a detailed checklist to compare

financing offer structures so you can make objective decisions between leasing or buying instead of

guessing based on rate alone.

Why Strategic Equipment Leasing is Crucial for Preserving Capital & Fueling Growth

Leasing is not just about affording the payment—it’s about using structure to protect cash and accelerate scale.

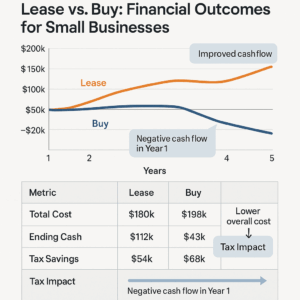

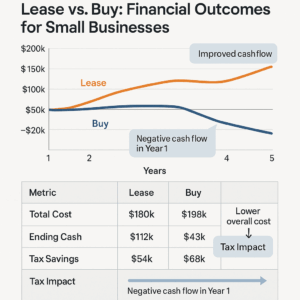

Strategic equipment leasing preserves capital by converting large capital expenditures into predictable operating expenses,

enabling aggressive growth strategies without draining cash reserves or diluting ownership. Done correctly, leasing supports

Business Growth by aligning lease terms with the equipment’s useful life and your revenue cycles.

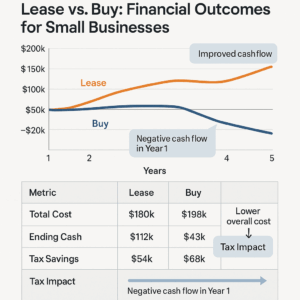

Industry experts recommend assessing lease-versus-buy scenarios with sensitivity analysis that considers

maintenance, tax treatment, and projected equipment obsolescence. Top providers like

Crest Capital and other leading lease firms offer practical solutions for high-priced assets and

large equipment lending, while specialty lenders tackle start-ups and nonstandard credit profiles.

For complex projects, pairing vendor finance programs with manufacturer partnerships can streamline

execution and increase certainty around project funding. Trackable metrics—return on leased asset, contribution margin per

month, and cash-on-hand impact—turn leasing into a measurable part of your financial plan instead of “just another payment.”

purchasing the same equipment.

The Evolution of Equipment Leasing Companies

From bank side-products to specialized national platforms—the market structure explains why terms look the way they do today.

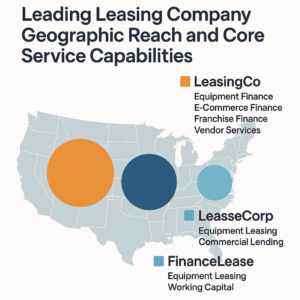

The evolution of equipment leasing companies runs from bank affiliates and manufacturer financing arms to today’s mix of

Direct Lender specialists, online business financing platforms, and international lessors that serve the

global economy. This history explains why firms like Crest Capital, Deutsche Leasing, and

Spar Leasing operate with different service models:

- Some emphasize Automated Underwriting and Same-Day Decisions

- Others focus on vendor finance program development and dealer relationships

- Some prioritize global reach and cross-border solutions

This evolution reshaped modern commercial financing services, enabling more fact-checked, accuracy-driven

offerings and faster approvals for business-critical assets. Market knowledge now includes competitor benchmarks like

National Funding and Currency Capital, and the rise of e-finance platforms has broadened access for small business,

start-ups, and manufacturers.

For finance teams, understanding this context helps when evaluating recommendations, comparisons, and independent research

into lease terms and lender reputations to support long-term growth—not just the next transaction.

technology adoption (manual underwriting → automated → digital platforms).

Current Landscape: How Leading Equipment Leasing Companies are Reshaping U.S. Financing

The best players blend speed, structure, and flexibility—without blowing up risk profiles.

In the current landscape, leading equipment leasing companies are reshaping U.S. financing by offering flexible underwriting,

digital applications, and bundled financing solutions tailored to specific business types and industries.

The best firms combine specialty lenders’ agility with nationwide reach, enabling fast approvals for both restaurant

equipment and construction equipment leases—critical when you need Same-Day Decisions to lock in pricing or secure inventory.

Industry Experience and Client Partnerships have become real differentiators. Vendors and

borrowers look for partners who can:

- Rapidly qualify equipment and borrowers

- Structure payment schedules that match cash flow patterns

- Support business-critical assets with responsive service

Leasing benefits include conserving capital, enabling Business Growth, and packaging a financing offer that can include

maintenance, insurance riders, and other protections. Comparing Direct Lender and

third-party provider models helps you secure the best mix of affordability, flexibility, and service.

Maximizing Business Potential: Advanced Strategies in Equipment Leasing & Project Financing

At scale, you don’t just “take leases” — you architect them around projects, milestones, and KPIs.

To maximize business potential, combine equipment leasing with project financing strategies that prioritize

capital preservation, predictable cash flow, and alignment with operational timelines. Advanced tactics include:

- Staging lease tranches to match project milestones

- Structuring residuals to facilitate asset turnover or upgrades

- Coordinating vendor finance programs with manufacturer discounts and incentives

When assessing providers, look for features like Automated Underwriting and Same-Day Decisions to reduce downtime and speed

deployment of leased assets. For objective benchmarking, compare offers from Direct Lenders and independent leasing partners

for solutions geared toward large equipment lending, new and used equipment, or specialty lenders serving unique verticals.

For planning, rely on detailed scenario modeling and input from industry experts or vendor finance program managers to tailor

financing offers that support both sales activities and vendor relationships. Consistently measuring lease

performance against Business Growth KPIs keeps leasing as a strategic tool—not just another cost line.

schedules and KPI tracking.

Understanding Robust Equipment Leasing for Maximizing Investment Plans & Preserving Capital

Robust means the deal still makes sense when conditions change—not just when everything goes right.

Robust equipment leasing integrates investment planning with operational forecasts so assets deliver their

ROI within the lease term and support Business Growth without draining capital. Key variables include:

- Lease duration versus expected useful life

- Depreciation expectations and technological obsolescence

- Residual value assumptions and early purchase options

Use conservative cash flow projections when negotiating lease terms, and check whether the equipment qualifies for vendor

finance program incentives or manufacturer rebates that effectively lower your financing cost.

For small business and start-ups, working with Direct Lender partners or specialty lenders can improve credit approval odds

while keeping future financing options open. Case examples—restaurants upgrading POS systems or manufacturers financing

robotic cells—show how leasing preserves capital and grants access to the latest technology while reducing downtime and

boosting productivity.

preservation checkpoints.

Key Concepts: Navigating Equipment Leasing Agreements & Project Financing

Miss one clause, and the deal can flip from smart to painful. You need to know what actually matters in the paperwork.

Key concepts in lease agreements include term length, early termination fees, maintenance responsibilities,

tax treatment, and purchase options at lease end. How you negotiate these points shapes total cost and operational

flexibility—often more than the headline rate.

Project financing via leasing often segments payments to match project milestones, ensuring funding aligns with asset

delivery, installation, and ramp-up. Contract clauses around asset usage limits, insurance requirements, and vendor finance

program participation can affect vendor relationships and service levels more than most operators realize.

Credit approval processes vary widely. Some providers lean on Automated Underwriting for speed, while others require detailed

financials and manual review. Understanding each model helps you plan documentation and lead times realistically, especially

for larger projects where delays cost real money.

For big, multi-asset initiatives, combining leasing with other commercial financing services in a hybrid

structure can optimize cash flow and reduce capital strain.

purchase options.

Important Factors: Evaluating Lease Duration & Affordability

The wrong term length or payment load can quietly wreck your cash flow, even if the rate looks “good.”

When evaluating lease duration, match the term to equipment useful life and expected maintenance cycles so

you’re not still paying for obsolete or unreliable assets. Affordability analysis must include:

- Interest rates and embedded fees

- Potential tax benefits and deduction timing

- Impact on operating expense ratios and covenants

Compare the financing offer against business loans and other small business loan alternatives. Consider how

lease payments affect cash flow available for payroll, suppliers, and marketing. Industry affiliations and strong vendor

relationships can unlock better terms or reduced fees, especially when manufacturers participate in vendor finance programs.

For start-ups and high-priced equipment acquisitions, specialty lenders and independent recommendations can provide creative

solutions that preserve capital while enabling essential growth investments. Always run scenario testing to

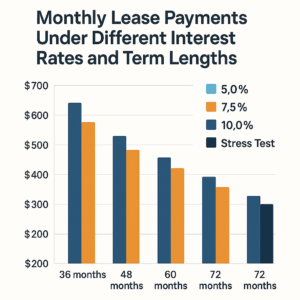

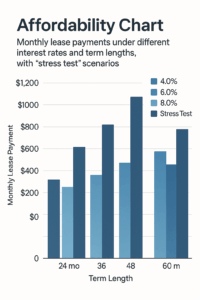

ensure lease terms remain affordable when revenue fluctuates—not just in your best case.

term lengths, with “stress test” scenarios.

In-Depth Analysis: The Impact of Equipment Leasing on Your Financing Business

If you’re not measuring the impact of leasing on your financials, you’re flying blind—no matter how “cheap” the deal looks.

A proper analysis looks at how equipment leasing changes key metrics from EBITDA and return on assets to

working capital ratios and your business banking relationships. Leasing increases operating expense visibility and can improve

cash flow by minimizing upfront capital expenditures, freeing money for sales activities and technology upgrades.

Study historical case studies—like manufacturing equipment leasing that enabled capacity expansion without equity raises—and

track metrics such as contribution margin per month and changes in cash on hand after each deal.

Industry experts recommend integrating lease data into forecasting models so Business Growth can be measured against the

performance of your financing strategy, not just top-line revenue.

For credit approval and underwriting, working with Direct Lenders or top lease providers often means faster decisions and

more specialized project funding solutions. Use these insights to determine whether leasing is supporting long-term strategic

objectives or simply acting as a short-term bridge to eventual ownership.

purchase scenarios.

Critical Elements: Choosing the Right Equipment Leasing Companies (Including Banks Like Wells Fargo)

Not all capital partners are built the same. Who you pick will show up in your speed, pricing, and flexibility for years.

Choosing the right equipment leasing company means scrutinizing credit approval processes, reputation,

fee transparency, and industry affiliations. Banks like Wells Fargo may offer integrated business banking

and leasing services that work well for companies looking to bundle products, but they’re not always the fastest or most

flexible.

Compare bank lenders to Direct Lender specialists by looking at:

- Same-Day Decisions and underwriting speed

- Automated Underwriting capabilities

- Vendor finance program support and dealer relationships

- Nationwide service coverage and industry focus areas

Smaller firms may prefer specialty lenders or independent leasing companies that deliver tailored financing

solutions for high-priced equipment or large equipment lending. Always request fact-checked references, star

ratings, and case studies to validate a partner’s performance against your objective financing goals—not their pitch deck.

Best Practices: Optimizing Your Equipment Leases with Flexible Underwriting

If you accept every term as-is, you’re leaving money and flexibility on the table. Negotiate like it affects your runway—because it does.

Best practices include negotiating flexible underwriting criteria that reflect projected cash flow rather

than just historical credit metrics. This is critical for start-ups and fast-growing companies that need equipment before

their financials look “perfect” on paper.

Look for partners that offer Automated Underwriting and Same-Day Decisions to reduce procurement delays. Review lease

structures for:

- Early purchase options at realistic residuals

- Maintenance inclusions and uptime guarantees

- Residual protections and fair return conditions

Regularly review your lease portfolio to reclassify underperforming contracts or to refinance strong deals with top lease

providers. Track metrics such as lease payment burden relative to revenue and each asset’s contribution to capacity and

margin. Educate procurement and finance teams on lease terms so everyone is playing the same game.

Implementing Smart Equipment Leasing Across Diverse Industries

The playbook is the same, but the priorities shift: restaurants, construction, and medical all care about different risks.

Implementing smart equipment leasing requires industry-specific thinking. For example:

- Restaurants focus on speed-to-deploy for kitchen and POS equipment

- Construction prioritizes uptime, durability, and large equipment lending options

- Medical facilities emphasize compliance, maintenance clauses, and technology refresh cycles

Smart implementation blends vendor finance program coordination, Direct Lender partnerships, and clear project funding plans

that include installation, training, and ongoing service. Leasing benefits include preserving capital for growth initiatives

while accessing the latest technology that improves efficiency and compliance.

A structured RFP process comparing financing solutions from Crest Capital, National Funding, and other

leasing companies helps uncover the best combination of pricing and service. Metrics like payback period, cash-on-hand

preservation, and operating expense impact should be embedded into your approval workflow.

Training procurement to understand lease qualification ensures equipment meets vendor and financing requirements and keeps

your deals aligned with long-term objectives and regulatory constraints—especially in medically regulated or heavily

inspected industries.

construction, and medical practices.

Turn Equipment Leasing into a Real Growth Lever

If you’re serious about preserving capital and scaling, leasing has to be designed—not improvised.

Start structuring your next deal with strategy instead of guesswork.