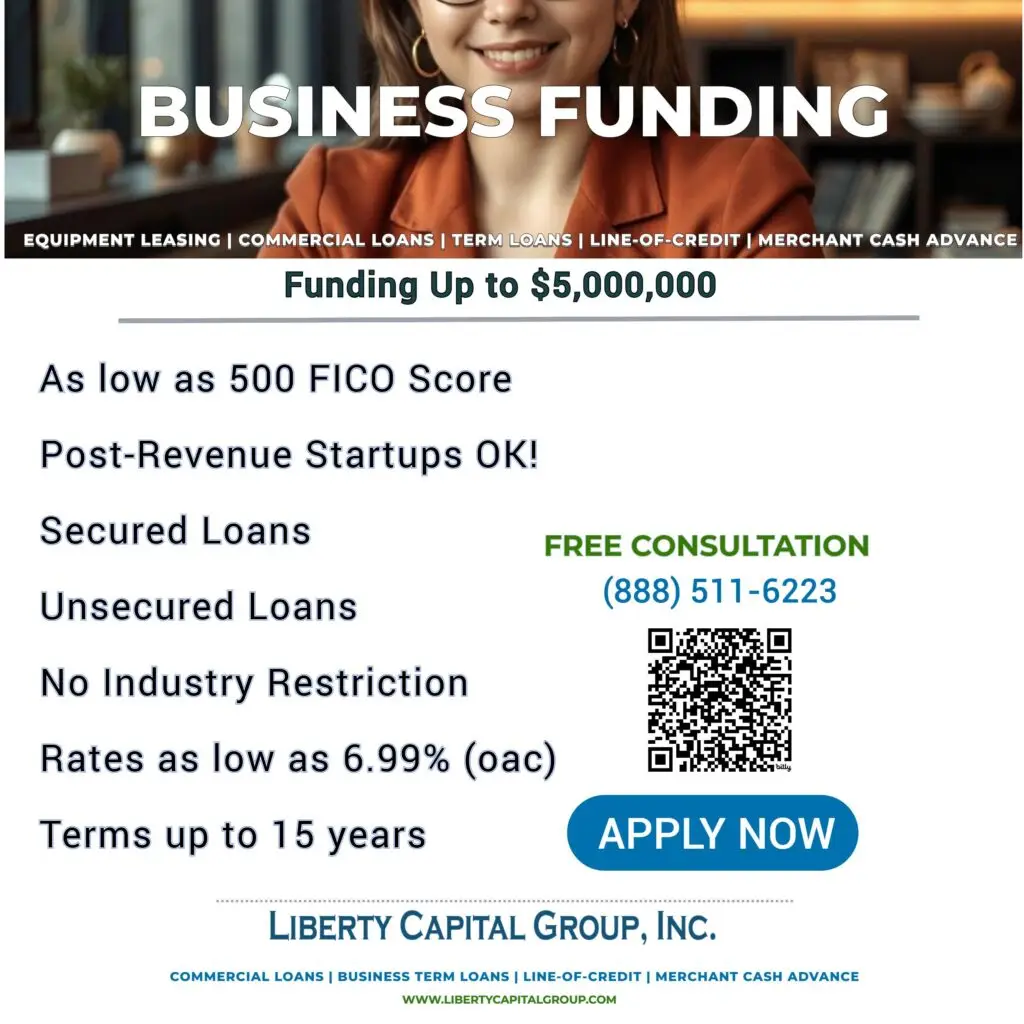

Business Loans Your Way!

Apply in minutes. Our commitment: We don’t sell your information.

01Pre-approval Form

Our online application will allow us to determine your approvability for the loan your business need. Upload statements securely.

021-on-1 Consultation

Once applied, your Funding Advisor will consult with you to discuss the right loan for your need to achieve the lowest rate.

03

Multiple Offers

We'll be provided with Multiple Business Loan Offers to compare. Your Funding Advisor will explain details of different loan types.

04

Funding

Once you've determined the right term, final documentation and funding underwriting to take place for smooth funding.

WHY LIBERTY CAPITAL GROUP, INC.

Tailored Financial Solutions

We understand that every business is unique. Our loan products are customized to meet the specific needs and goals of your business.

Competitive Rates and Terms

We offer some of the most competitive interest rates and flexible repayment terms in the industry. Access Funding Source nationwide from a licensed Loan Broker.

Dedicated Support

Funding advisors dedicated to your success. From your initial loan inquiry to the final repayment, we offer personalized support and guidance every step of the way.

Proven Track Record

Celebrating 20 years in business, we’ve proudly helped countless businesses thrive! Our proven track record spans various industries. We empower your business to succeed.

What is the right business loan for me?

It’s essential to distinguish between necessity and want, need and wish.

Business Loans

Business Loans That Make Sense! Loans can be defined broadly, but getting the right loan is crucial to unlocking what fuels your growth.

Restaurant Equipment Financing

Revitalize Your Restaurant with Financing and Leasing. Growth Opportunities lies ahead. Whether you're start up or established company.

Commercial Truck Financing

Looking to expand your fleet? Explore our custom-tailored commercial truck lease and financing options designed for businesses aiming to expand.

Medical Equipment Financing

Medical and healthcare equipment loans are aimed to utilize capital to expand, open new locations, or invest in new technology.

Dealers & Vendors Financing

Boost your sales with our vendor financing. If you sell equipment to businesses, our financing and leasing programs can support your clients. Contact us today!

Funding For the Blue Collars

Subcontractors are the backbone of our economy. Liberty Capital can help subcontractor businesses expand with Equipment Loan and Working Capital.

What you apply for, what you qualify for, and what you ultimately receive can often be three different things. That’s why it’s important to work with a trusted licensed lender and loan broker who can save you time and money.

Business Funding Reviews

At Liberty Capital Group, Inc. our clients’ success stories speak for themselves. We are committed to providing exceptional service and tailored financial solutions to help your business thrive. Join the many satisfied clients who have trusted us with their business financing needs. Contact us today to learn how we can support your growth journey.

Latest Blog

Local Business Loan in Hawaii Supporting Hawaii’s local businesses with fast, flexible financing. From Honolulu to Hilo, Maui to Kauai—Liberty Capital helps …

THE COMPLETE GUIDE TO ACCRUAL VS. CASH BASIS ACCOUNTING Why Profitable Businesses Go Broke, How Your Accounting Method Hides (or Reveals) Your …

THE COMPLETE GUIDE TO STRATEGIC BUSINESS FINANCING Why Smart Business Owners Apply for Term Loans and Lines of Credit Together, Keep Credit …

THE COMPLETE GUIDE TO PERSONAL GUARANTEES IN BUSINESS LENDING What Every Business Owner Must Know About PGs, Corporate-Only Financing, and Why Your …