Revenue Based Working Capital Qualification

What Do You Need to Get Approved?

Simple application. Fast decisions. High approval rates for qualified businesses.

Overview

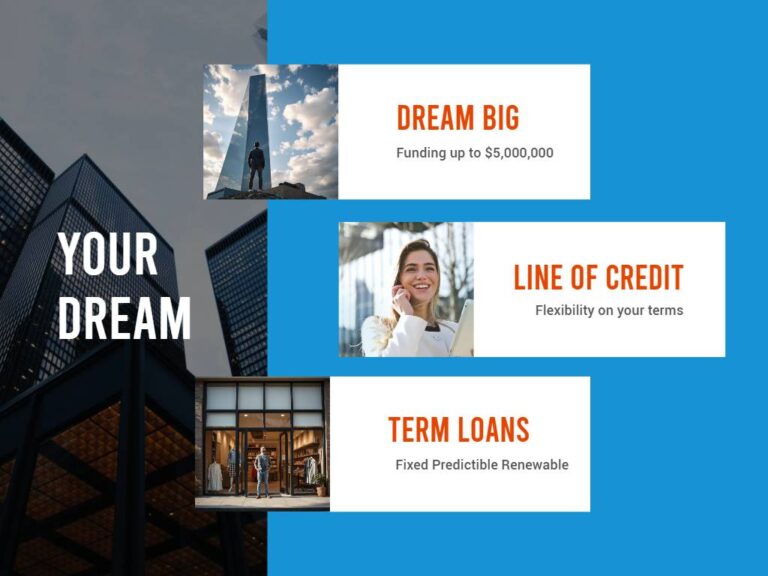

Liberty Capital is committed to helping small business owners secure the revenue-based capital they need to thrive. We keep it simple with a streamlined application and a low-documentation path for qualified requests.

Join the thousands of businesses that have trusted Liberty Capital Group with their financing needs. Our goal is to help you achieve your objectives and take your business to new heights—with one of the highest approval rates in the industry.

What We Need to Review

- Online Application (simple, secure)

- Recent Business Bank Statements (typically last 3–4 months)

That’s it to begin. We’ll guide you if anything else is needed for the best offer.

We Look Forward to Working with You

Our team is here to help. If you’d rather speak with a specialist first, call us anytime.

Minimum Requirements to Get Funded

- Minimum Time in Business: At least 3 months

- Monthly Revenue: Minimum $5,000

- Business Bank Account: Required for deposit and repayments

- No Minimum Credit Score: Credit is not a strict determining factor

- For Funding > $150K: Recent tax returns, current P&L and Balance Sheet

This option is ideal for businesses seeking a quick and flexible solution to support growth, manage cash flow, or invest in new opportunities—without giving up equity or pledging traditional collateral.

Why Revenue-Based Working Capital?

Revenue-based funding aligns with your actual cash inflows. It’s versatile for businesses with steady revenue streams and lets you grow without traditional debt covenants or equity dilution.

- Preserve ownership — avoid selling equity

- Move fast — low-doc pathway available for qualified requests

- Use of funds — inventory, marketing, payroll, equipment deposits, and more

How the Process Works

- Online Application: Complete the simple application on Liberty Capital’s website.

- Approval: Swift decisions, often within 24 hours.

- Funding: On approval, funds may be deposited quickly to your business account.

- Low-Doc Funding: In some cases, required items prior to funding can be as little as a driver’s license and voided check.

Helpful Resources (Guides & Tools)

MCA Education & Comparisons

- MCA Debt Consolidation vs. Reverse MCA (Read Before You Touch Your MCA Debt)

- Eligibility Requirements for an MCA

- Merchant Cash Advance FAQs

- MCA Early Repayment Discounts vs. Prepayment Penalties

- What Is a Factor Rate? Impact on Total Repayment

- Is a Merchant Cash Advance a Loan?

Vendors & Tools

- Download Our Vendor Package

- Vendor Credits & Guidelines

- Funder Intel – Funding Companies List

- DataMerch Review (Quote2Fund)

Program Pages

Eligibility & FAQs

LCG Blog