Heavy Equipment Financing for Small Business Owners by Liberty Capital Group, Inc.

Heavy Equipment Financing for Small Business Owners

Since 2004, Liberty Capital has provided flexible, tailored solutions for new or used heavy equipment, yellow iron, and commercial trucks. Our funding advisors work to secure the best approval, terms, and funding—fast. (Our very first funding: a used excavator in 2005.)

Application Only up to $250K

Secure up to $250,000 for new or used heavy equipment with minimal documentation and fast approvals.

Low-Doc Requirements (Typical)

- No financials or tax returns up to $250K (well-qualified)

- 3–5 years in business

- Strong Paydex & PayNet history

- 680+ credit score & comparable credit

- No liens, bankruptcies, or judgments

- Qualified heavy equipment / machinery / commercial trucks

Why It Works

- Speed to approval & funding

- Bank-light documentation

- New or used equipment eligible

- Can include delivery, install, tooling, training

*Program eligibility varies by credit profile, time in business, and collateral.

Benefits of Leasing Heavy Equipment

Hedge Against Inflation

- Fixed payments: Keep costs predictable across the term.

- Smaller installments: Preserve cash for payroll, fuel, mobilization, and bids.

- As prices rise over time, your fixed payment becomes relatively cheaper.

Tax Benefits

- Operating expense deductions: Lease payments may be deductible.

- Section 179 / bonus depreciation: Depending on structure—consult your CPA.

- Avoid potential depreciation recapture complexities on sale.

Advantages

- Conserve capital for higher-ROI needs

- Flexibility at term: return, upgrade, or own ($1 buyout)

- Build assets via finance structures (“equity builder”)

Disadvantages

- Monthly payments; equity accrues primarily at/after term

- Can cost more than purchasing over the long run

Straight talk: Don’t use daily/weekly merchant cash advances to buy equipment—they choke cash flow and limit future approvals. Finance the asset with terms that match your revenue cadence.

Compare Business Loans vs MCA vs Equipment Financing

| Feature | Business Loans | Merchant Cash Advance | Equipment Financing |

|---|---|---|---|

| Ownership | 50% | 50% | 100% |

| Origination/Admin/Titling Fees | Low | Low–Moderate | Varies |

| Payment Frequency | Monthly/Daily/Weekly | Daily/Weekly | Monthly |

| Credit Minimum | 600 | 500 | 650 |

| Fund Disbursement | Client | Client | Vendor |

| New/Used Equipment | n/a | n/a | Yes |

| Maximum Term | 24 mo | 12 mo | 60–84 mo |

| Time in Business | 2+ yrs | 6 mo | Startup OK (program-dependent) |

| Rates | Moderate | High | Low |

| Application-Only | $150K | $250K | $250K |

| Funding Time | Same Day | Same Day | 1–5 Days |

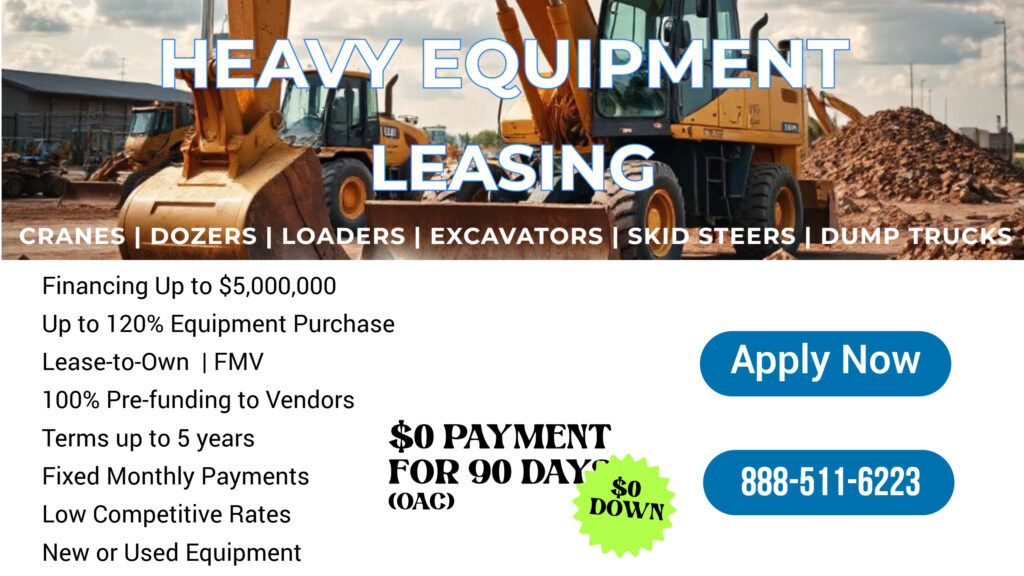

What You Get with Liberty Capital

Program Highlights

- $0 down for qualified clients

- 90-day deferred payments

- Seasonal & annual payment plans

- 12–84 month terms

- Up to 120% equipment cost

Approvals & Limits

- App-Only ≤ $250,000

- Financials to $5,000,000

- New & used assets eligible

- No prepayment penalties (select programs)

- Does not appear on personal credit

Structures

- Equipment Finance Agreement (EFA)

- $1 Buyout / Capital Lease

- FMV / Operating Lease (incl. 10% options)

- Sale-Leaseback

- Lease-Rental Purchase Option (RPO)

Qualifications & Current Promotions

Typical Qualifications

- Stable business history

- Financials/tax returns over $100K–$250K (as requested)

- Reasonable credit & comparable credit

- Use case & equipment details

- Down payment/security may be required for startups or lower credit

Promotions

- $99 for the first 6 months (select programs)

- 90-day deferred payments

- $0 down equipment financing (qualified)

- Seasonal or annual payment plans

No bank-hopping: We package your deal correctly the first time—based on your actual profile—so you avoid being shoved into the wrong (expensive) product.

Types of Heavy Equipment We Finance

Construction

- Excavators, bulldozers, backhoes, loaders

- Cranes, graders, rollers

- Skid steers, telehandlers

Agriculture & Industrial

- Tractors, combines, balers, sprayers

- Forklifts, conveyors, presses

- Warehousing & CNC (VMC)

Trucks & Specialty

- Utility & commercial trucks, delivery vehicles

- Yellow iron & high-resale assets

- Mining & forestry (as eligible)

How to Apply

What You Need

- Online Application: Complete and authorize processing (soft pull; lender hard pull may occur at approval).

- Equipment Invoice/Quote: Multiple vendors accepted; we can combine to one payment.

- 3–4 Months Bank Statements: Verify income/banking; set up ACH autopay upon approval.

Simple 4-Step Process

- Instant Quote — no obligation.

- Apply Online — about 5 minutes.

- Review Options — FMV vs $1 buyout/EFA, end-of-term choices.

- Get Funds — typically 1–5 days after final approval.

Prefer a quick conversation? Call us at 888-588-4128. We’ll match the structure to your work and cash-flow realities.

FAQs

Do you finance used equipment and private-party sales?

Yes—program dependent. We routinely finance used assets, private sellers, and offer sale-leasebacks on owned equipment.

Can I include delivery, installation, tooling, and training?

Often yes. Many programs allow up to ~120% to include eligible soft costs. Approval varies by credit, equipment, and time in business.

Are startups eligible?

Program-dependent. Strong personal credit, down/security, and right equipment profile improve approvals for startups.

Application Only up to $250K for Heavy Equipment Financing

Liberty Capital offers a streamlined financing option for heavy equipment purchases called the “Application Only” program. This program allows businesses to secure up to $250,000 in financing for new or used heavy equipment with minimal documentation and a fast approval process.

Low Doc Equipment Financing Requirements:

v No Financials or Tax Returns up to $250k (for well qualified clients)

v 3-5 years in business

v Good Strong: Paydex and Paynet History

v Credit Score of 680+

v Comparable Credit

v No prior business or personal liens, BK’s and judgments.

v Qualified New or Used Heavy Equipment, Machinery and Commercial Trucks.

Types of Heavy Equipment Financing and Leasing

- Off balance sheet financing – Fair Market Value, 10% FMV

- Capital Lease – $1 buyouts.

- Equipment Finance Agreement

- Lease Rental Purchase Option (RPO)