Construction Equipment Financing Guidelines

Construction Equipment Financing Credit Guidelines

Financing & Leasing Solutions For Construction Equipment

| Feature | Equipment Loan | Equipment Leasing | Equipment Financing |

| Ownership | Yes, after loan repayment | No, unless purchase option is used Or LEASE TO OWN | Varies EFA |

| Initial Costs | Moderate to high | Low to moderate | Varies |

| Monthly Payments | Fixed | Fixed | Variable |

| Tax Benefits | Interest & depreciation deductions | Lease payment deductions | Depends on tax structure |

| APplication Only | Up to $75K | Up to $150K | Varies |

| Builds History | Yes | Sometimes NOT | YEs |

| Long-term Costs | Potentially lower | Potentially higher | Varies |

| Credit Minimum | 650 | 590 | 600 |

Covers many types of construction equipment we can finance.

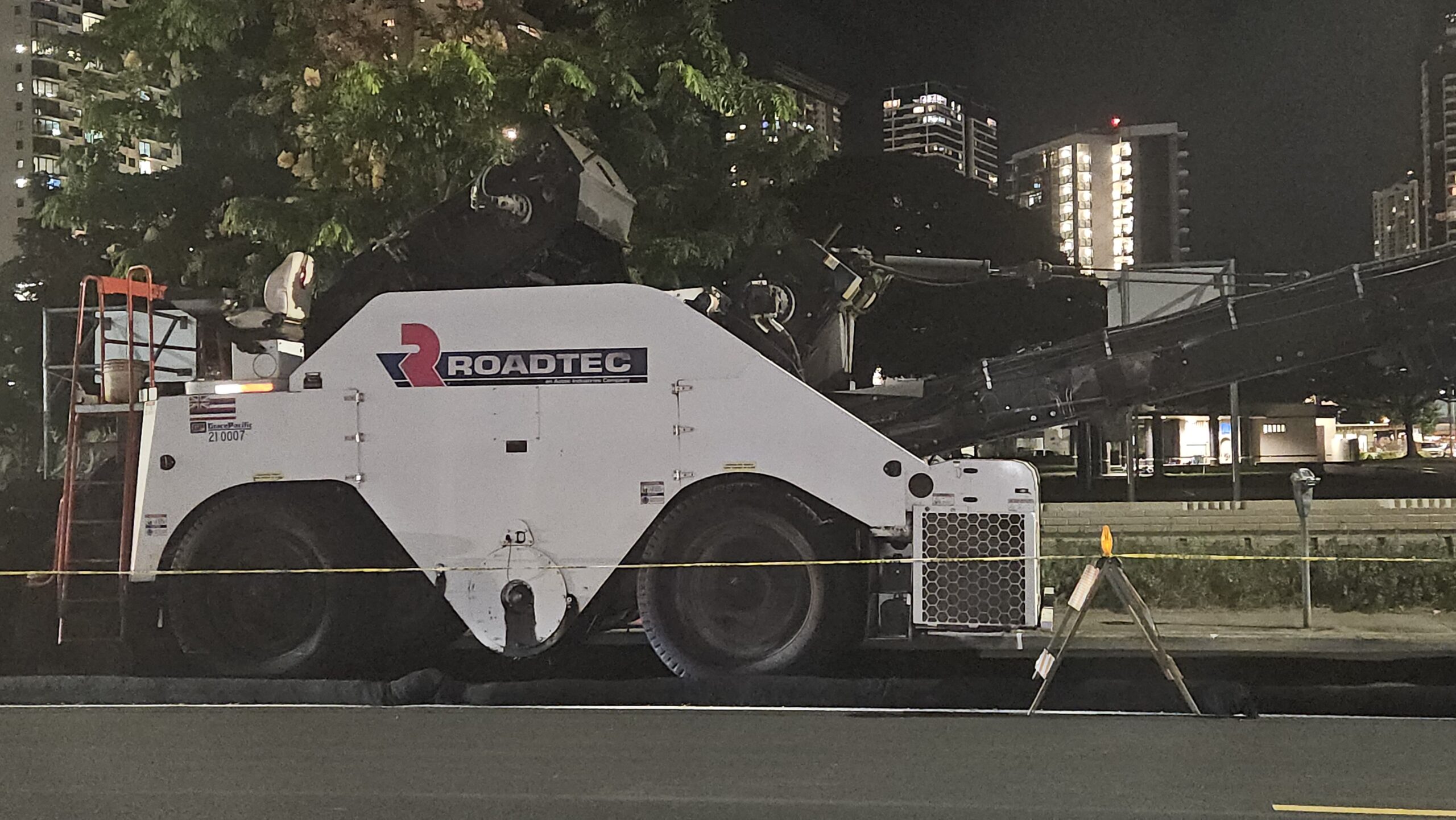

Asphalt Equipment

Backhoe Equipment

Backhoe Loader Equipment

Special Equipment Lease and Financing Programs

Searching for the right equipment lender especially if you’ve already been turned down by your bank, by hopping from one bank to another just trying to figure out whether they will approval you can be a time-consuming and frustrating process, especially if you have challenging credit. Each application involves time-consuming paperwork and potential rejections. If you get turned down, how many more lenders will you apply to before seeking better options from a loan broker?

Special Financing programs:

- $0 Down for qualified lessee

- 1 Advance Payment

- 90-day deferred payment

- $1 buyout, no prepayment penalty

- Monthly payment up to 5 years

- Equipment finance Agreement

- Low Admin and doc fee

- $99 for first 6 months (OAC)

Working with an equipment loan broker like Liberty Capital can streamline the process, saving you both time and money. Brokers have access to multiple lenders that can structure any credit profile specific to you, even if your credit is less than perfect. With their expertise and network, brokers can navigate the complexities of loan applications and increase your chances of approval. You may not know all the intricacies of equipment financing thus a loan broker will be able to help you navigate.

So why go through the hassle of bank hopping when Liberty Capital can do the work for you, ensuring you get the best possible deal?

The Construction Equipment Financing Application Only up to $250,000

Construction companies often face significant upfront costs for acquiring essential equipment. Financing can help. However, managing these expenses, preserve cash flow, and enable businesses to stay competitive is another challenge. That’s why it’s important to work with someone you can trust. Liberty Capital Group, Inc. has been serving the construction industry for 20 years. We know construction equipment financing inside out. We cater to all types of credit including startups.

Types of Construction Equipment you can finance.

- Heavy Equipment: Excavators, bulldozers, cranes, loaders, backhoes, graders,

- Earthmoving Equipment: Trenchers, logging equipment, drilling equipment

- Material Handling Equipment: Forklifts, telehandlers.

- Concrete Equipment: Mixers, pumps, pump trailer, pump trucks

- Road Construction Equipment: Pavers, compactors, asphalt milling machines.

- Commercial Trucks – tractor trucks, commercial trucks

- Commercial Trailers – dry van trailers, enclosed trailer, refrigerated trailers

- Plumbing Equipment – Pipe Camera, service trucks and heavy equipment

- Roofing Equipment – lift, boom lift, forklift, crane trucks

- Landscaping Equipment – commercial lawn mowers, tree trimmers, mulcher,

Financing and leasing construction equipment is a strategic decision that can impact a company’s financial health and operational efficiency. Understanding the available options and their benefits can help construction companies make informed choices that support growth and sustainability.

For more personalized advice and detailed information on financing options, construction companies should consult with financial experts or reach out to providers like Liberty Capital Group.

Easier to get than a traditional business loan

Less paperwork

Fast processing time

Less stringent requirements for qualifying

No collateral needed, the equipment is the collateral

May require less credit score for you and your business as well

What do I need to apply?

1. ONLINE APPLICATION: You can fill out our application, upload and authorized us to process your application. We do soft-inquiry, and our lender will do hard inquiries once you are approved for Equipment Financing only.

2. Equipment Invoice or Quote for the truck or equipment you want to buy. Multiple vendors accepted. We’ll lump them into one monthly payment for you. We’ll accept bill-of-sale for some private sale.

3. Banks statements (3-4 months) – Proof income, proof of banking, and proof funds availability in case down payment is needed and to match for ACH Payment Drafting – as an auto pay.

Credit Requirements for Startup Construction Companies

For startup companies, we require: Credit requirements Varies. Here’s how you get your ducks in a row to make sure you make it easy for the lender approve you.

- Business license or active business entity registration.

- Personal guarantees from all owners – history matters.

- Minimum 650+ credit score.

- No bankruptcies in the last 7 years.

- No unresolved tax liens.

- No judgments, or repossessions

- Sufficient networth

Are you an Equipment Vendor??

If you sell new or used trucks, trailers or machinery including medical equipment, we’d love to partner with you to offer highest approval rate for your clients. Our goal is to get them approved no matter what their credit profile might be. Working with Liberty Capital will give you a wider credit window so you can stop shopping for your clients. We do soft-inquiry for each applicant.

- Check out how you can grow your vendor business using our financing options. View our credit guidelines here.

- Download our equipment vendor package here.Get Started Today!

If you’re seeking a reliable funding partner for your new or used construction equipment financing needs, apply online today or call our Funding Specialists at 888-588-4128 for personalized assistance. Let Liberty Capital Group, Inc. empower your business with comprehensive financing solutions tailored to your clients requirements.

Our small business financing experts are available to guide you through the funding Process.

Despite technological advancements, loans, especially in construction equipment financing, predominantly involve personal interaction with an underwriter to ensure as fraud prevention. Automation may not suffice, particularly when dealing with a third party like the vendor and the complexities of equipment purchase. In such scenarios, business owners are often better served by collaborating with a Business Loans Broker like Liberty Capital Group, Inc., who can steer them in the right direction.

Instant Quote Online

Use our instant online quote calculator to get an accurate no obligation quote.

Apply Online

Complete our quick online application. Application takes 5 mins.

Review Your Options

We will contact you to review your options.

Get Funds

Money will be deposited in your account in as little as 24 hours.

Vendor Sign Up

Are you equipment dealer or vendor?

please click here to signup for a vendor program, no payment for 90 days, monthly payments upto 60 month

Apply for financing for your customer as a vendor

Get Started Today

Our application process is easy. Simply fill out our quick, online application and start the process of securing financing for your start up practice. Our knowledgeable finance experts are here to assist you in obtaining a start up financing loan.

If you have any questions, we invite you to contact us

- 619-795-3123

- Mon – Fri: 6:00 am – 6:00 pm (EST)