Get Competitive Terms and Rates for Commercial Truck Leasing & Financing

Commercial Truck Financing & Leasing Solutions

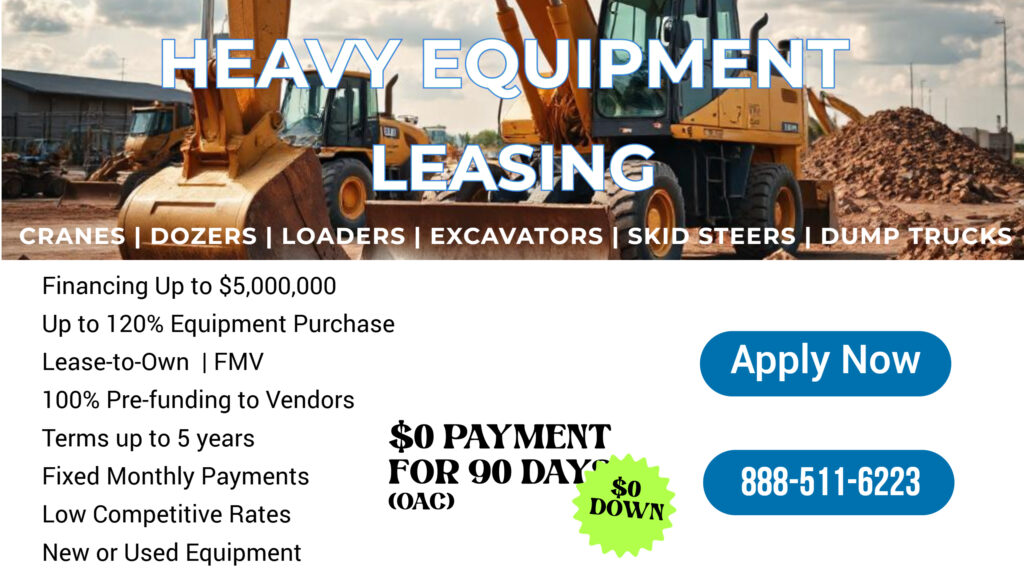

Affordability is key when it comes to acquiring a used commercial Trucks. Our financing options offer the flexibility you need to manage your cash flow effectively while investing in the equipment necessary to grow your business. With longer loan terms of up to 72 months, we can help you reduce your monthly payments and make owning a high-ticket item like a heavy duty commercial trucks more manageable.

Compared to traditional lenders, we offer several advantages:

- Corp-Only Available: We cater to businesses of all sizes, including corporations.

- Up to 120% Equipment Cost: Our financing solutions can cover not only the equipment cost but also soft costs associated with acquisition.

- Fast Approval Process: With our simple one-page application, you can get Funding Approval as quickly as the next day.

- No Down Payment Required: Qualified borrowers may access financing without the need for a down payment.

- Lowest Rates: We offer competitive rates for qualified borrowers, ensuring you get the best financing terms available.

- No Pre-Payment Penalties: Enjoy the flexibility of paying off your loan early without any penalties.

Looking to upgrade your fleet with a new Commercial Truck Leasing? At Liberty Capital Group, Inc., we understand the importance of having reliable equipment for your waste management business. Commercial trucks are essential assets that allow you to efficiently transport and dispose of various materials, from transportation, construction debris to household waste.

Credit Requirements for commercial truck lease financing:

For startup companies, we require:

- Business license or active business entity registration.

- Personal guarantees from all owners.

- Minimum 650 credit score.

- No bankruptcies in the last 7 years.

- No unresolved tax liens.

- 10% to 40% down payment depending on credit, owner operator and asset age/cost/types

For non-startup companies, we require:

- No Financials up to $150K

- Personal guarantees from all owners.

- Minimum 600 credit score.

- No bankruptcies in the last 7 years.

- No unresolved tax liens.

- 0% to 10% down payment depending on credit, owner operator and asset age/cost/types

- Equipment Financing: Spread the cost of the truck over time with fixed payment terms.

- Equipment Leasing: Lease a truck with off-balance sheet financing options like Fair Market Value (FMV) leases.

Additional Financing Benefits:

- $99 for the First 6 Months: Get started with minimal upfront costs.

- 90-Day Deferred Payments: Pay nothing for the first three months.

- Working Capital Loans: Access short-term cash flow solutions for immediate needs if company is generating revenue already. Working capital loan doesn’t apply to pre-revenue start ups.

So, if you want expand your commercial trucking business operation, we can handle working capital, term loans, lines of credit and especially Used Heavy Equipment, including commercial trucks, tractor truck, dry van trailers, sleeper truck, day-cab trucks and many heavy duty trucks and trailers all can be financed. Apply now to get your business capital to grow. Call now 888-511-6223.

Commercial Truck Lease Financing Application Only up to $250,000

One of the utmost necessities for trucking companies are the two essential equipment – commercial truck and trailer. It’s imperative to ensure that operational equipment, which serves as an asset for the company, is well-maintained and kept current. Equipment loans or leasing are viable routes for expanding your trucking and construction company. Commercial Truck Lease Financing, in particular, offers numerous advantages, though they won’t be explored here today. One notable benefit of truck leasing is the accompanying tax advantages, cashflow saving, inflation buster and safety from obsolescence.

Covers many types of commercial equipment we can finance.

Recycling Equipment

Waste Truck

Crushers and Garbage Tractors

Easier to get than a traditional business loan

Less paperwork

Fast processing time

Less stringent requirements for qualifying

No collateral needed, the equipment is the collateral

May require less credit score for you and your business as well

Why Commercial Truck Financing Matters

Preferred Leasing Vendors

Utilizing our extensive experience in commercial truck financing on tractor rucks, we can assist you in finding reputable vendors for new or used equipment. Additionally, if you’re a vendor seeking financing for commercial trucks, we’re ready to serve your needs.

Get Started Today!

If you’re seeking a reliable funding partner for your commercial truck lease financing needs, apply online today or call our Funding Specialists at 888-588-4128 for personalized assistance. Let Liberty Capital Group, Inc. empower your business with comprehensive financing solutions tailored to your requirements.

At Liberty Capital Group, Inc., we offer aggressive financing programs designed to meet the diverse needs of our clients. Our solutions typically involve two primary options:

– Equipment Financing: Spread the cost of your new or used trucks over time with fixed payment terms.

– Equipment Leasing: Opt for off-balance sheet financing with Fair Market Value (FMV) leases, providing flexibility at the end of the lease term.

Additional Lease Financing Benefits for Well-Qualified Lessees include:

– $99 for the First 6 Months: Start with minimal upfront costs.

– 90-Day Deferred Payments: Pay nothing for the first three months.

– Working Capital Loans: Access short-term cash flow solutions for immediate needs.

– Fast Approvals: Apply online for funding up to $250,000 with a Streamlined Process.

Our small business financing experts are available to guide you through the funding Process.

Despite technological advancements, loans, especially in commercial truck lease financing and equipment financing, predominantly involve personal interaction with an underwriter to ensure as fraud prevention. Automation may not suffice, particularly when dealing with a third party like the vendor and the complexities of equipment purchase. In such scenarios, business owners are often better served by collaborating with a Business Loans Broker like Liberty Capital Group, Inc., who can steer them in the right direction.

Instant Quote Online

Use our instant online quote calculator to get an accurate no obligation quote.

Apply Online

Complete our quick online application. Application takes 5 mins.

Review Your Options

We will contact you to review your options.

Get Funds

Money will be deposited in your account in as little as 24 hours.

Bank Hopping for Equipment Loans: Why It’s Time-Consuming and How Liberty Capital Can Help.

Searching for the right equipment lender especially if you’ve already been turned down by your bank, by hopping from one bank to another just trying to figure out whether they will approval you can be a time-consuming and frustrating process, especially if you have challenging credit. Each application involves time-consuming paperwork and potential rejections. If you get turned down, how many more lenders will you apply to before seeking better options from a loan broker?

Working with an equipment loan broker like Liberty Capital can streamline the process, saving you both time and money. Brokers have access to multiple lenders that can structure any credit profile specific to you, even if your credit is less than perfect. With their expertise and network, brokers can navigate the complexities of loan applications and increase your chances of approval. You may not know all the intricacies of equipment financing thus a loan broker will be able to help you navigate.

So why go through the hassle of bank hopping when Liberty Capital can do the work for you, ensuring you get the best possible deal?

What do I need to apply?

1. ONLINE APPLICATION: You can fill out our application, upload and authorized us to process. We do soft-inquiry, and our lender will do hard inquiries once you are approved.

2. Equipment Invoice or Quote for the truck or equipment you want to buy. Multiple vendors accepted. We’ll lump them into one monthly payment for you.

3. Banks statements (3-4 months) – Proof income, proof of banking, and proof funds availability in case down payment is needed and to match for ACH Payment Drafting – as an auto pay.

Equipment financing is vital for businesses that need expensive equipment to operate efficiently. Companies in construction, manufacturing, healthcare, and other heavy equipment-intensive industries benefit significantly from these financial solutions. Understanding the options and working with top financing companies can help businesses acquire necessary equipment while managing cash flow effectively.