What are the Qualifications for Backhoe Financing?

Backhoe Financing Options — Lease, Finance, or Bank

Fixed, predictable payments up to 60 months. App-only to $250,000. New or used, dealer or private seller. $0 down or security deposit OAC.

Why Fixed Payments Beat Inflation

Backhoes depreciate. Financing with fixed payments locks today’s dollars against tomorrow’s higher costs—an inflation hedge. Keep cash free for payroll, fuel, materials, and change orders while the asset earns revenue.

What Are My Backhoe Financing Options?

- Traditional Bank Loan: Blanket lien on business; may be low-rate but slower and down-payment heavy.

- Backhoe Equipment Lease (FMV or $1): Lowest payment with FMV; end-of-term buy/return/renew. $1 buyout if you plan to keep.

- Backhoe Equipment Financing (EFA): Own day one; the backhoe is collateral—no blanket lien.

- Line of Credit: Flexible but best for working capital, not long-life depreciating assets.

We’ll model total cost and cash-flow for each structure before you sign.

Quick Compare — Loan vs Lease vs EFA

| Feature | Business Loan | Equipment Leasing | Equipment Financing (EFA) |

|---|---|---|---|

| Ownership | After payoff | Optional (FMV) / $1 | You own day one |

| Initial Costs | $0–Down & fees | Low to moderate | Varies |

| Payment Pattern | Monthly / Daily / Weekly | Monthly | Monthly |

| Credit Minimum | ~500+ | ~600+ | ~650+ |

| Max Term (typ.) | 24 mo | 60 mo | 60 mo |

| Used Assets | Bank-averse | Yes | Yes |

| Reports to Personal | Sometimes | Usually no | Usually no |

Terms vary by asset age/condition, time-in-business, bank balances, and credit depth.

Qualifications — What Lenders Actually Look At

- Time in Business (TIB): #1 driver. Startups get tighter terms unless revenue is strong.

- Credit: Higher FICO lowers payment; sub-600 can still work with down/security deposit.

- Banking: Average balances, NSF history, deposit volatility.

- Asset: Year/make/model, hours, resale market, dealer vs private party.

- Structure: FMV for lower payment/refresh; $1/EFA for equity.

Every File Is Unique — Industry • Credit • Equipment

Concrete, utility, sitework, landscaping, municipal, ag—and each has different cycles and margins. We tune approvals to your project rhythm: seasonal payment relief, deferred starts, or step-up schedules when big jobs kick in.

- Strong revenue, thin credit: Lean on bank statements; consider EFA.

- Great credit, tight cash: FMV lease with low or $0 down OAC.

- Used / older unit: Shorter term, larger residual, or small deposit.

Pros & Cons (Owner & Lender View)

| Lease (FMV) | $1 Lease | EFA | Pay Cash | |

|---|---|---|---|---|

| Cash Preservation | Best | Strong | Strong | None |

| Inflation Hedge | High (fixed) | High | High | Low |

| Upgrade Flex | High | Medium | Medium | Low |

| Lender Risk | Residual risk | Collateral risk | Collateral risk | — |

| Total Cost | Low payment; FMV at end | Low; own asset | Low; own asset | Opportunity cost |

For depreciating assets, fixed-payment financing is the cost-effective path—your cash stays productive while the machine earns.

Stop Bank-Hopping

Each lender has a credit window. Applying one-by-one wastes time and pulls credit repeatedly. We underwrite once, place with the right lender, and structure around asset age, TIB, and banking so you land highest approval, longest term, lowest rate available to your profile.

Backhoe Financing for Startups

- Up to 100% purchase financing

- App-only to $150k–$250k; SBA up to $3M (with financials)

- Terms 12–60 months; next-day approvals possible

- $0 down or security deposit OAC; startup target FICO ~650+

- Often doesn’t report to personal credit

Not ready to buy? Short-term rental can bridge jobs; shift into lease/finance once pipeline stabilizes.

Special Programs & Perks

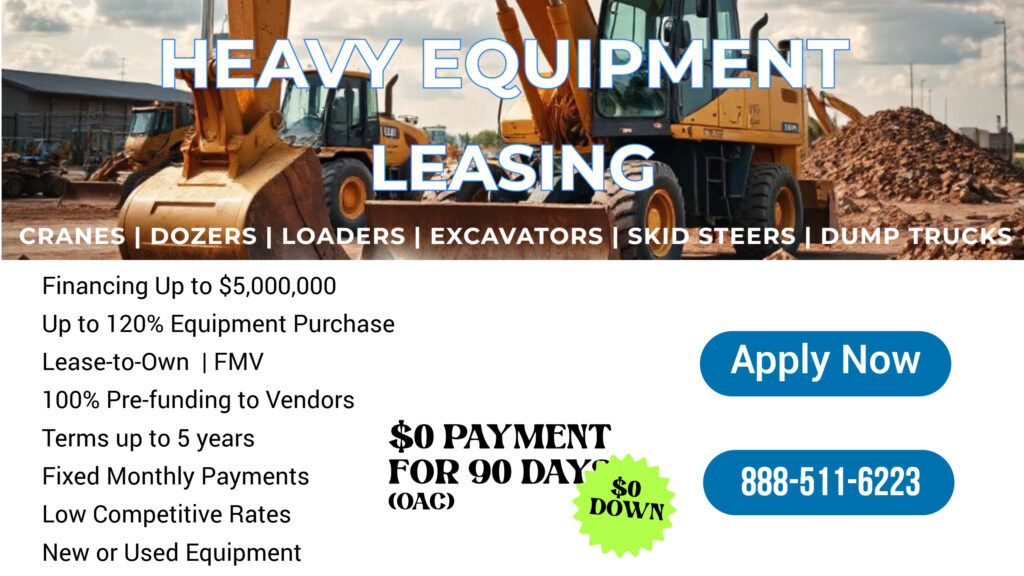

- Deferred 90-Day Payments (qualified files)

- $99 for first 6 months starter program

- Seasonal or step-payment schedules

- Early payoff discount addendum (program-specific)

- Soft costs (delivery, install, warranties) often includable

Leases/EFAs are generally non-cancellable; “no prepayment penalty” means payoff follows remaining-obligation math. We price it clearly.

What Do I Need to Apply?

- Online Application: Submit & authorize (soft inquiry to start; hard pull at final approval).

- Equipment Invoice or Quote: Dealer or private party OK; we can bundle multiple items into one monthly payment.

- 3–4 Months Bank Statements: Verify cash-flow and set ACH.

Use Capital Where It Pays Back

- Office & hardware upgrades • Fleet refresh

- Replace obsolete machinery • New tools & tech

- Working capital for payroll, fuel, mobilization

Other Funding Solutions Under One Roof

Battle Inflation. Build Equity. Keep Cash.

We structure to your industry, credit, and asset—so you get the longest term, lowest rate, and fastest vendor pay your profile supports.

Ready to price your backhoe? We’ll compare FMV vs $1 vs EFA and lock in a cash-flow-friendly payment.

Business Loans vs. Equipment Leasing vs. Equipment Financing

Feature | Business Loans | Equipment Leasing | Equipment Financing |

Ownership | 50% | 100% | 100% |

Initial Costs | $0 (orig fees) | Low to moderate | Varies |

Monthly Payments | Monthly, Daily, Weekly | Monthly | Monthly |

Credit Minimum: | 500 | 600 | 650 |

Fund Disbursements | Client | Vendor | Vendor |

New/Used Equipment | n/a | Yes | Yes |

Maximum Term | 24 months | 60 months | 60 months |

Time in Business | 3+ years | Startup OK | Startup Ok |

Interest Rates | Moderate | Low | Low |

Application Only | $150K | $250K | S250K |

Funding Time | Same Day Funding | 1-3 days | 1- 5 days |

Use the Capital as you see fit!

Office Upgrades

Upgrade Hardware & Office Furniture

Replacement

Replace Obsolete Equipment

Fleet

Revamp Your Fleet

Machinery Upgrades

Upgrade Aging Machinery

Latest Tech

Catch up with the latest technology

New Tools

Become Efficient and Productive with new tools

Startup Equipment Financing for Construction Business

Startup Equipment Financing for Construction Business

For startups, having reliable equipment is crucial, but you can start without it if you’re in construction industry by doing short-term rental. Typically, higher cost of borrowing but with many benefits. However, instead of paying high rental fees without the equity or ownership, equipment leasing for construction start up business from Liberty Capital can provide top-notch startup funding.

Leasing for startups can provide the benefits of affordable, fixed monthly payments, preserving your working capital for growth essentials.

Our used backhoe financing for Startups can get your business off the ground running. These are the typical financing advantages when it comes backhoe financing

- Up to 100% purchase financing

- Up to $150,000 with a straightforward application, or

- SBA Loans up to $3,000,000 with financial disclosure

- Next-day funding, with pre-funding options available for towing equipment vendors

- Fixed payment terms spanning 12 to 60 months.

- No down payment requirements for qualified borrowers

- Lowest rates in the industry for qualified borrowers

- Eligibility for all new and used equipment purchases, without impacting personal credit reports.

- Minimum FICO: 650 for starts at a pre-revenue level. Once you have revenue, there might be better chance for those with less than 650 credit.

Therefore, Backhoe equipment financing has many benefits. It will save your business cashflow by financing depreciating assets. Avoid obsolescence and inflation buster. Don’t forget it builds asset for the business while benefiting from tax deductibility under IRS section 179 of these types of purchase. these types of equipment can be too expensive to buy, and anyway, they depreciate so fast.

Flexibility of Used Backhoe Financing

Backhoe Financing involves obtaining funds to purchase a Backhoe through various funding sources. Most popular is equipment leasing, equipment financing like dollar buyout or equipment finance agreement. Backhoe are specialized equipment equipped with hydraulic hoe, front loader is another backhoe that’s similar equipment that can be more flexible for its utility.

v Lenders consider several factors when approving financing new or used backhoe, any other heavy duty yellow iron or construction equipment.

v Credit Score: Higher credit scores generally secure better interest rates and term. Even with low credit score, due to the nature of the equipment you can still qualify for financing.

v Business Financials: Lenders review the business’s financial health, including revenue, profits, and cash flow depending on the funding request as well as business and personal profile.

v Down Payment: A substantial down payment can improve approval chances, reduce payments and reduce overall financing costs.

v Collateral: The Backhoe itself typically serves as collateral, though additional assets may be required for larger loans or for low credit scores.

Application Only up to $250K

Whatever your Equipment Financing and Leasing needs, we are here to help!

Over 80% of small businesses nationwide utilize some form of funding and big part of it is equipment financing and leasing. Besides the tax benefits, cash flow and leveraging fixed asset is one big reason big companies lease their equipment majority of the time rather than using cash to pay for fixed asset.

Wide Range of Terms

Monthly Payment & Fixed Payback

Express Funding

Express Financing for Approvals Up to $75,000

Credit Score

Minimum 600 FICO Score Requirement

Large Funding

Equipment Leasing or Financing up to $500,000 per Location

Working Capital Funding

Easy Apply to Qualify Process (24-48 Hours)

Start Ups

Start ups for Equipment financing accepted.

Tax Deductibility of Equipment Financing

Liberty Capital understands that Cash Flow is king, which is why we offer Special Financing Programs, designed to accommodate clients with financing options requiring minimal working capital outlay, low documentation coupled with fast approval and funding. Approval requirements vary based on many factors such as time in business (TIB), credit, equipment type, industry type, and other underwriting considerations.

**Equipment Financing Special Program: **

Deferred Payments

Deferred Payments allows you to make no payments up to 90-days for qualified borrowers.

Seasonal Payments

Make small payment up to 90-days each year based on your seasonality. Make once a year for farmers.

Early Payoff Discount

Early Payoff Addendum Discount. Calculated based on the number of payments made at time of payoff.

Large Funding

Equipment Leasing or Financing up to $500,000 per Location

Fast Funding

Easy Apply to Qualify Process (24-48 Hours)

Start Ups

Start ups for Equipment financing accepted.

Flexibility of Backhoe Equipment Financing with Liberty Capital.

Equipment Financing Made Easy

No Application Fee

No Sales Minimum

No Additional Collateral Required

No Down Payment Required

No Payment for 90 Days

Special Financing Options

Finance New or Used Equipment, Machinery or Vehicles

Industry Restriction-free

What’s Your Expansion Needs?

Our small business financing experts are available to guide you through the funding Process.

Despite technological advancements, loans, especially in backhoe equipment financing, predominantly involve personal interaction with an underwriter to ensure as fraud prevention. Automation may not suffice, particularly when dealing with a third party like the vendor and the complexities of equipment purchase. In such scenarios, business owners are often better served by collaborating with a Business Loans Broker like Liberty Capital Group, Inc., who can steer them in the right direction.

Instant Quote Online

Use our instant online quote calculator to get an accurate no obligation quote.

Apply Online

Complete our quick online application. Application takes 5 mins.

Review Your Options

We will contact you to review your options.

Get Funds

Money will be deposited in your account in as little as 24 hours.