| Business Loans | Equipment Finance | Merchant Cash Advance |

Funding Amount – App Only | $75K | $250K | $250K |

Underwriting Difficulty | Median | Median | Basic |

Pre-Credit Docs | Application, Tax Returns, Statements | Application, invoice, bank statements | Application, bank statements |

Credit Minimum | 650 | 600 | 500 |

Time in Business | 2 years | Start-up Ok! | 6 months |

Payment | Weekly/Monthly | Monthly | Daily/Weekly |

Min Monthly Revenue | $50,000 | Pre-revenue OK! | $5,000 |

Needed To Fund | VC, DL, proof of ownership | Vendor invoice, VC, proof of ownership | VC, DL, proof of ownership |

Maximum Term | 2-5 Years | 3-5 Years | 6 to 12 Months |

Financing Special For Landscaping Equipment

- $99 for the first 12 months, requiring only a nominal start-up fee.

- 90-Day Deferral, offering zero payments for the initial three months

- Seasonally Varied plans, aligning payments with fluctuating cash flows.

- “Stepped Down” Leases, with payments reflecting depreciation.

- Fast online approvals for amounts up to $150,000.

- Stabilize cash flow during the off-season for landscaping business with 90-day deferred program.

- Get $0 down payment for Landscape Equipment Financing for well qualified customers

- Get monthly payment up to 5 years for new trucks and trailers, mulcher, chippers, or grinders and many more..

- Down payment from 5% to 40% for clients with bad credit, prior delinquencies including start ups.

- Lease-To-Own or Fair Market Value.

Take advantage of new opportunities to grow or expand while leveraging lender’s funds.

We can finance any type of new or used landscaping equipment you might need for your landscaping business. We can finance any new or used from “Top 10 Most Expensive Landscaping Equipment” Landscapers Use.

- Backhoe Loader

- Skid Steer Loader

- Excavator

- Commercial Lawn Mower

- Tractor with Attachments

- Stump Grinder

- Hydroseeder

- Tree Spade

- Compact Track Loader

- Commercial Wood Chipper

Not to mention the bucket trucks, boom trucks, mulcher, tree trimmer, tree cutter and everything that a landscaper or a tree service companies uses. Liberty Capital Group understand how landscaping and tree service industry have ups and down due to seasonality, so source of stable capital and funding is critical to make sure you’re ready for the next season. Speak with a Customer Specialist today toll-free 888-511-6223. Or APPLY NOW

Did you Know 85% of Small Businesses Seek Capital Multiple Times a Year for Growth?

Since 2004, many customers have stayed with us for over a decade. Even if you’re still with the same lender, our options have evolved to offer better loans. If you have questions about renewals or equipment financing, we have solutions for you. When it comes to business loans, having the right partner you can trust and come back to when you need funds is critical. Lenders come and go but business loan brokers adapt. We’d love to work with you. We can provide new, add-on capital, or renewal financing without paying off your current lender or help pay it off if the balance is low enough. Just send us 4 months of bank statements for a FREE pre-approval analysis. We’ll present to you multiple funding offers that you can decide without pushy salesperson.

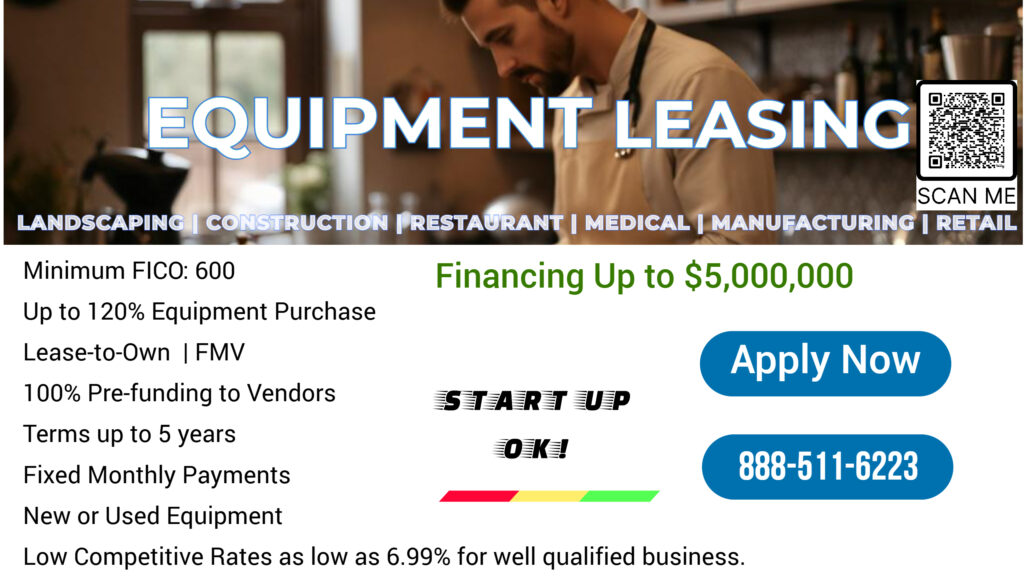

What is Equipment Financing?

- Purpose: To purchase or lease business-related equipment.

- Features: Typically secured by the equipment itself, with fixed interest rates and repayment terms that match the useful life of the equipment.

- Benefits: Enables businesses to acquire essential machinery and tools without large upfront costs.

What is Equipment Leasing?

- Purpose: To acquire the use of equipment without purchasing it outright.

- Features: Agreements to lease equipment for a specified period with fixed payments, with options to purchase at the end of the lease.

- Benefits: Lower upfront costs, potential tax benefits, and the ability to upgrade equipment periodically.

- There is a buyout when equipment leasing. It can be Dollar Buyout or Lease to own, or FMV true leases, 10% FMV.

Whether you decide to lease, borrow, or buy outright, you will find yourself in need of an equipment leasing and financing is more easily accessible through your trusted funding source Like Liberty Capital. Cashflow is King once it’s paid you can’t cash out of business equipment when you need working capital. Fixed asset should not be paid with liquid cash. There’s no such thing as secondary equipment marketplace who will refinance your paid off equipment for cash. You can always do Sale Lease Back. Liberty Capital understands that it’s not just equipment financing it’s all about the cashflow.

Startup Equipment Financing for Landscapers.

For startups, having reliable equipment is crucial to get a momentum for your growing business. With Liberty Capital, you can acquire top-notch gears through affordable, fixed monthly payments, preserving your working capital for growth essentials, equipment financing and leasing.

Our startup equipment financing advantages include:

- Up to 90% purchase financing

- Up to $50,000 with a straightforward application only

- Commercial Loans up to $3,000,000 with financial disclosure

- Next-day funding, with pre-funding options available for beauty salon equipment vendors

- Fixed payment terms spanning 12 to 60 months.

- Down payment maybe required for not so qualified borrowers

- Lowest rates in the industry for qualified borrowers

- Eligibility for all new and used equipment purchases, without impacting personal credit reports.

- Minimum FICO: 650 for starts at a pre-revenue level. Once you have revenue, there might be better chance for those with less than 650 credit.

- ONLINE APPLICATION: You can fill out our application, upload and authorized us to process. We do soft-inquiry, and our lender will do hard inquiries once you are approved.

- Equipment Invoice or Quote for the equipment you want to buy. Multiple vendors accepted. We’ll lump them into one monthly payment for you.

- Banks statements (3-4 months)

Once we have your application, your funding advisor will reach out to discuss the process, timeline, and expectations. We’ll then make an offer and if accepted, we’ll reach out to the vendor for payment instruction. We can pre-fund any vendor up to 100%. We can do used equipment up to 60 months.